Connelly Supreme Court Case

In June 2024, the Supreme Court unanimously ruled that company-owned life insurance should be included in a company’s fair market value and also determined that a buy/sell redemption obligation is not necessarily a liability that reduces a company’s value for federal estate tax purposes.

Details of the Case:

- Crown C Supply, a small building supply corporation, was owned 77.18% by Michael Connelly and 22.82% by Thomas Connelly.

- There was an agreement between the two brothers that the surviving brother would have the option to purchase the deceased brother’s shares, and if he declined, the company itself would be required to redeem the shares. The company owned life insurance policy provided for $3.5 million in proceeds upon either brother’s death to fund this share redemption obligation.

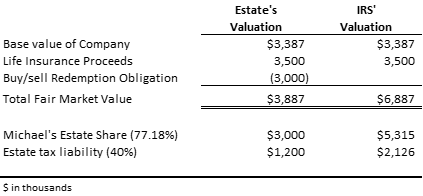

- The buy/sell redemption agreement indicated that Michael’s shares were worth $3.0 million, and this was the value reported on the federal tax return for the estate.

- Upon an Internal Revenue Service (IRS) audit, Thomas obtained a third party valuation of Crown C Supply determining that the fair market value of the business at the time of Michael’s death was $3.9 million. This value did not include $3.0 million of the insurance proceeds used to redeem Michael’s shares as the valuation determined the $3.0 million of proceeds and $3.0 million redemption obligation offset each other.

- The IRS argued that the life insurance proceeds payable to a company are an asset that increases fair market value and that the contractual obligation to redeem a shareholder’s shares at fair market value does not reduce a company’s value for purposes of the federal estate tax.

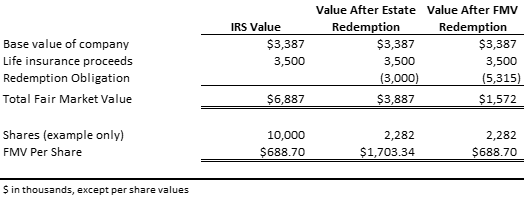

- Throughout the appeals process, courts agreed that a fair market value redemption does not impact any shareholder’s economic interest. Accordingly, a hypothetical buyer would not see Crown’s obligation to redeem Michael’s shares at fair market value as lowering their value. For example, if a third party buyer purchased Michael’s shares knowing that those shares were entitled to be redeemed by the company at fair market value, they would expect to receive the $5.3 million (77.18% x $6.9 million). Therefore, Crown’s redemption promise does not reduce the value of those shares.

- As shown in the example above, there is no impact to the fair market value per share price before or after the redemption if the redemption is completed at fair market value. In fact, the remaining shareholder would have received far more value by only redeeming Michael’s shares for $3.0 million.

What Does this Mean for Your Business?

This Supreme Court decision emphasizes the importance of understanding how life insurance proceeds used for share redemptions are treated for estate tax purposes. If your company owns life insurance and the shareholders will be subject to estate tax, you should review your buy-sell agreement and consider restructuring the insurance ownership.

Chartwell, along with your tax advisors, can help you assess the potential impact on your estate. Understanding the value of your business is an initial step in ensuring that your business succession and estate plans still align with your goals.