Equity Value – What Drives Growth?

Companies often attempt to increase value through improved cash flow from additional revenue generation, margin improvements, or reductions to capital spending. However, many firms overlook the potentially significant impact working capital improvements can have on equity value. Projected cash flows can benefit significantly from decreasing the average number of days the receivables are outstanding by making changes to the company’s collection patterns and procedures.

For example, let’s analyze a hypothetical company that generates gross revenue of $80.0 million, net revenue of $68.0 million, and EBITDA margin of 10.0% ($6.8 million). Let’s say the company’s “as-is” equity value is $45.0 million.

We then pose the following question: Which of the following improvements would increase the company’s equity value the most?

- An increase in the company’s projected sustainable net revenue by 16.4%, from $68.0 million to $79.2 million, with no change to the EBITDA profit margin into perpetuity[1]

- An increase in the company’s projected sustainable EBITDA margin by 110 basis points into perpetuity (i.e., enhance profit margin by 11.0%, for example going from a 10.0% profit margin to an 11.1% profit margin) [2]

- An improvement in the management of the company’s net working capital balances by decreasing the days in sales outstanding (“DSO”) from 100 days to 70 days into perpetuity[3]

Trick question! All of the above have an $8.0 million impact on equity value.

Normalized Net Working Capital Balances

A company can have either positive or negative normalized net working capital balances.

A company with large accounts receivable or inventory balances would typically have a positive normalized net working capital balance (think manufacturing, professional services, distributors, or retailers). This type of company has to invest cash into their net working capital balances if their revenue is growing.

Alternatively, a company with high deferred revenue balances would typically have a negative normalized net working capital balance (think SAAS/subscription companies, airlines, hotels). This type of company does not need capital for growth and actually generates cash from its net working capital balances if their revenue is growing.

All other things being equal, it is more “expensive” for a company with a positive normalized net working capital balance to grow than it is for a company with a negative normalized net working capital balance. However, a company with a positive normalized net working capital balance can decrease this “cost of growth” by decreasing the days that receivables are outstanding. By doing this, the company will receive cash faster, which would increase the company’s enterprise and equity value.

More specifically, there are two effects on the company’s equity value: (i) a point-in-time effect on the balance sheet (net working capital valuation adjustment) and (ii) impact on future cash flows.

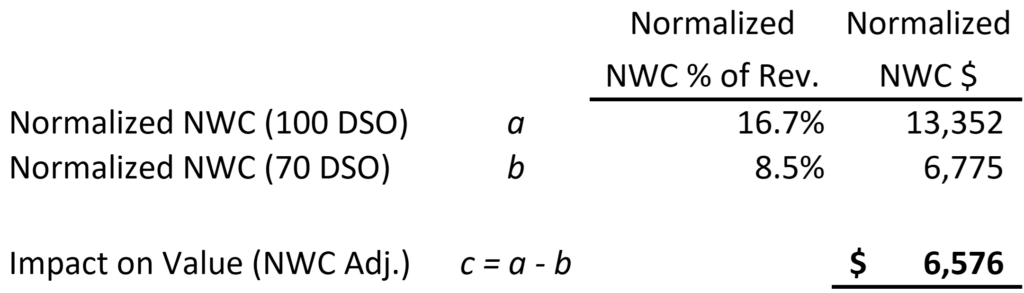

The impact on the company’s point-in-time value is illustrated below:

If the company were to have a normalized net working capital balance based on 70 DSO, the company would have a net working capital surplus of $6.6 million.

The impact on the company’s future cash flows is illustrated below (our example is employing the discounted cash flow methodology, with a terminal multiple assumption):

As shown above, it “costs” more to grow the company if DSO is 100 versus 70.

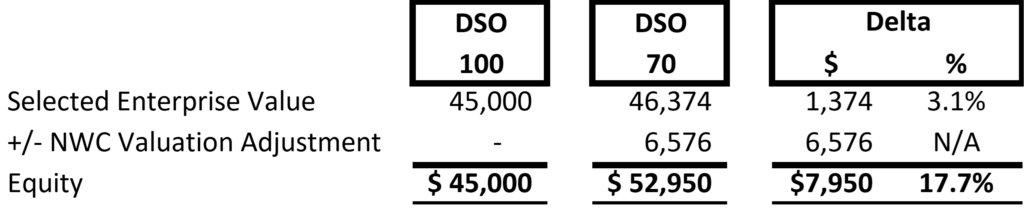

The net impact of both effects are shown below:

In the hypothetical case above, if the company were to decrease the average days their receivables are outstanding from 100 to 70, the company’s equity value would increase by over 17.7%!

Using AI or sending invoice reminders regularly to your clients to encourage speedier collections across your organization is a simple yet effective way to increase your company’s value.

[1] $8.0 million impact on equity value

[2] $8.0 million impact on equity value

[3] $8.0 million impact on equity value