A trademark is a powerful marketing tool that helps companies create awareness of their product or service offerings with customers or prospective customers.

From an accounting and financial reporting perspective, a trademark is an intangible asset. If a trademark was acquired, its impact on the acquirer’s financial statements depends on the trademark’s useful life. If its life is indefinite, the trademark would be tested annually for impairment and would not be amortized.[1] If its life is finite, the trademark would be amortized straight-line over its remaining useful life.[2]

For tax purposes, a trademark can be amortized ratably (i.e., straight-line) over 15 years in the United States, per Section 197 of the Internal Revenue Code.[3] This can be important for companies as trademark amortization can have a positive effect on cash flow by providing tax benefits.

Valuation of a Trademark

The Relief from Royalty Method (“RRM”), which uses aspects from the market and income valuation approaches, is often used in valuing a trademark. This method attempts to approximate the value of a company-owned trademark by estimating what the company would have to pay a third party to use the asset in a hypothetical scenario where the company didn’t own the trademark.

The first step of the RRM is to establish an estimated market royalty rate for the trademark based on existing licensing agreements for similar assets. Leading data sources for these agreements include RoyaltySource, RoyaltyRange, and ktMINE. This step is akin to searching for comparable publicly traded companies when employing the guideline public company method. The licensing agreements reflect a royalty rate on sales between a licensor and licensee and usually describe the intellectual property being licensed, the term of the agreement, the geographical scope, etc. After analyzing comparable licensing agreements and selecting an appropriate market royalty rate, that rate is then applied to the revenue stream that is benefiting from the trademark to estimate “royalty savings” over the remaining useful life of the trademark. The royalty savings are then tax-effected, discounted back to present value, and summed up to derive a value for the trademark.

Other Thoughts When Valuing a Trademark

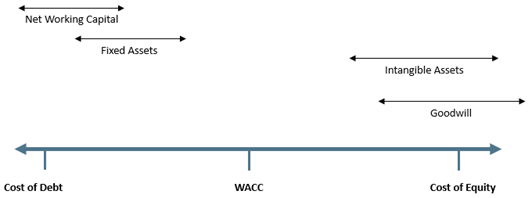

The discount rate used when valuing a trademark is usually greater than or equal to the company’s weighted average cost of capital (“WACC”), as intangible assets are usually riskier than tangible assets such as net working capital or property, plant, and equipment. The chart below illustrates a general continuum of discount rate ranges by asset classes.

Chartwell Valuation Services

Valuation is the core of Chartwell’s business; virtually all of our services include valuation as part of the engagement. Our nationally recognized valuation practice provides independent analyses and comprehensive reports tailored to stakeholders’ unique needs across a wide range of industries.

[1] FASB 350 Intangibles—Goodwill and Other 350-30-05-4

[2] FASB 350 Intangibles—Goodwill and Other 350-30-35-6

[3] Internal Revenue Code, Title 26, Subtitle A, Chapter 1, Subchapter B, Part VI, § 197; https://uscode.house.gov/browse/prelim@title26/subtitleA/chapter1/subchapterB/part6&edition=prelim